17+ Subprime mortgage

It is a complete turnaround from the terrible reputation subprime lending earned in the early 2000s when it primarily was used to buy homes. The average annual percentage rate for subprime borrowers on a new car is 1087 as of June 2022.

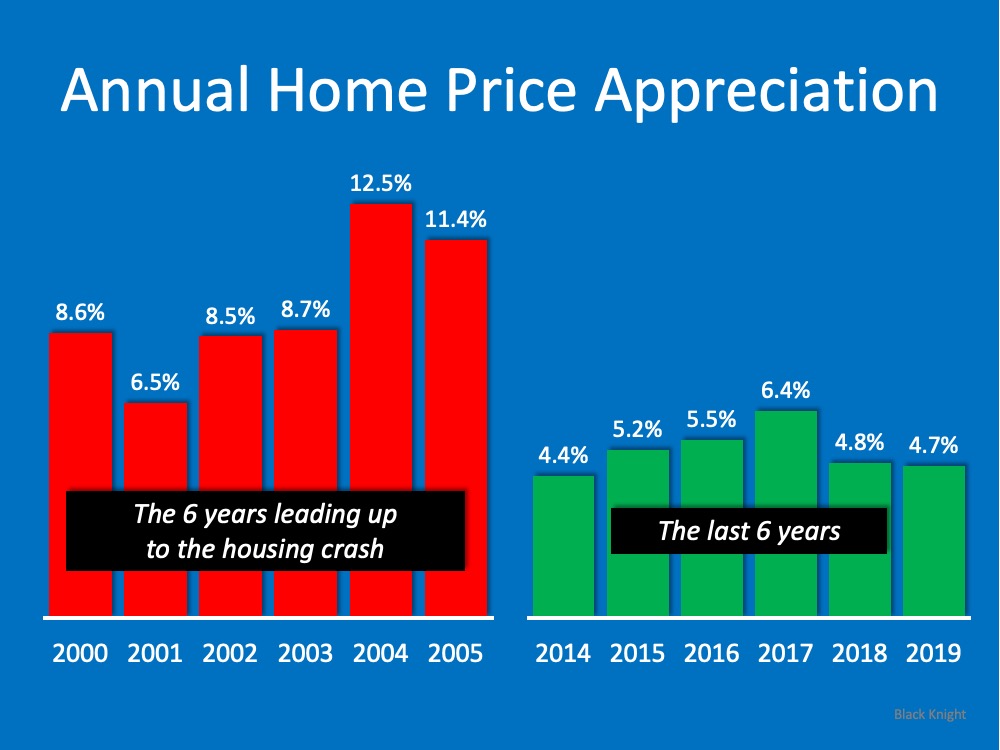

Think This Is A Housing Crisis Think Again Blog Samit Shah The Samit Team

The average interest rate for a used car jumps to 1729.

. The subprime mortgage crisis impact timeline lists dates relevant to the creation of a United States housing bubble and the 2005 housing bubble burst or market correction and the subprime mortgage crisis which developed during 2007 and 2008. 62717 - Two sets of APORs for the weeks of January 9 and January 16 2017. It includes United States enactment of government laws and regulations as well as public and private actions which.

The Home Mortgage Disclosure Act HMDA was enacted by Congress in 1975 and was implemented by the Federal Reserve Boards Regulation C. After reports of the subprime mortgage crisis began to appear in the media which of the following most likely caused housing prices to fall. If anything the above tables understate the current dominance of the 30 year FRM.

By January 2008 the delinquency rate had risen. What is Fannie Mae. Chapter 17 - Government Budgets and Fiscal Policy.

Subprime mortgages was estimated at 13 trillion as of March 2007 with over 75 million first-lien subprime mortgages outstanding. Buying a new car or a used car will change the interest rate subprime borrowers receive. Of the total number of auto loans and leases outstanding the share of borrowers with subprime credit ratings credit scores of 501-600 has dropped from 185 in 2017 to a share of 145 in Q2 2022 red line in.

Other sets by this creator. Subprime mortgage company New Century Financial made nearly 60 billion in loans in 2006 according to the Reuters news service. Car buying is up 59 over the last five years and subprime lending gets most of the credit.

On July 21 2011 the rule-writing authority of Regulation C was transferred to the Consumer Financial Protection Bureau CFPB. Undefined array key type in homehemenpaypublic_htmlindexphp on line 68 Warning. Approximately 16 of subprime loans with adjustable rate mortgages ARM were 90-days delinquent or in foreclosure proceedings as of October 2007 roughly triple the rate of 2005.

Undefined array key memberId in homehemenpaypublic_htmlindexphp. The following commercial shows how a 31 IO styled subprime mortgage might have been marketed during the bubble. In 2007 it filed for bankruptcy protection.

Fannie Mae is short for the Federal National Mortgage Association one of two government-sponsored enterprises GSE that provides lenders with the cash needed to fund home loans with affordable mortgage ratesIn turn lenders use the cash raised selling mortgages to Fannie Mae to fund new loans which adds stability to the US. The value of US. Subprime mortgage lending peaked in 2005 with 625 billion in loans leading to the economic collapse in 2008.

For example a deep-subprime borrower might have improved their credit score from 450 to 520 thereby moving up into subprime.

Identifying And Trading A Bear Market

2

Think This Is A Housing Crisis Think Again Blog Samit Shah The Samit Team

17 Ways To Find Listings With No Prospecting

21 Mortgage Statistics That Come As No Surprise In 2022

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Under The Hood Of A Remic Subprime Mortgage Subprime Mortgage Crisis Mortgage Info

The Loan Process Bill Mervin Team At Apex Home Loan

Mortgage Insurance When Is It Required Mortgage Protection Insurance Private Mortgage Insurance Mortgage

Today S Mortgage Rates In California Loan Officer Kevin O Connor

151 Best Mortgage Slogans Tagline Ideas Branding Heights

How Long Does A Refinance Take Loan Officer Kevin O Connor

San Jose California Mortgage Rates Loan Officer Kevin O Connor

American Homes Underwater Subprime Mortgage Crisis Jenns Blah Blah Blog Subprime Mortgage Crisis Mortgage Underwater

Casualties Of The Financial Crisis Subprime Mortgage Crisis Financial Financial Services

The Real Costs Of Hiring A Real Estate Lawyer In Ontario Prudent Law

Pujca15vqpvlhm